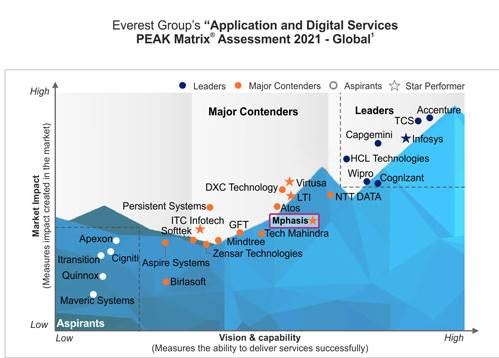

We are pleased to announce that Mphasis is recognized as a “Major Contender” and “Star Performer” in Everest Group PEAK Matrix® for Application and Digital Services in Global Banking Service Providers 2021.

Evolving customer preferences, demand for digital and omnichannel experiences, and competition from FinTechs are impacting banks’ digital strategy and transformation initiatives. COVID-19 has drastically accelerated their plans for organization-wide, end-to-end digitization and adoption of digital technologies for use cases such as digital customer onboarding, real-time payments, paperless underwriting, and real-time cash management.

One of the biggest challenges the banking industry faces is the shortage of technical skills in the market. IT service providers invest heavily in building banking industry-specific solutions and an engineering talent pool to respond to the evolving demand themes. Enterprises seek support from these providers to shift to a platform-based operating model, cloud-first approach, data value realization leveraging AI/ML, and APIfication.

Mphasis is acknowledged for our continued investment in next-generation digital technology solutions, Front2Back™ transformation - a framework enabled by X2C2™ methodology and cloud partner-led GTM strategy embedded with cloud enablement expertise for enterprise platform services that resonates well with banking clients.

Strengths of Mphasis

- Grown revenues from application and digital services in banking through increased investments in next-generation digital technology solutions, leading to large deal wins for digital transformation in North America

- Investments in technology tribes such as, and experience for consumer banking, mortgages, and payments enabling us to win new deals for “change the bank” engagements

- Acquisition of Datalytyx strengthened our capabilities to provide managed data platform and engineering services for analytics on Snowflake and Talend environments to banking clients

- Proactive account-level investment to drive messaging around innovation by showcasing business use cases, helping us scale key banking accounts

Learn more